Essential Guide to Schengen Visa Insurance: Requirements, Coverage, and Best Practices 2025

Essential Guide to Schengen Visa Insurance: Requirements, Coverage, and Best Practices 2025

Last updated: May 10, 2025

Quick Summary:

Schengen visa insurance is a mandatory requirement for all travelers applying for a Schengen visa. This comprehensive guide covers the 2025 insurance requirements, how to select the right policy, cost-saving strategies, and digital verification processes. Learn how to ensure your insurance meets all criteria to avoid visa rejection and travel with confidence throughout the Schengen Area.

Table of Contents:

- Introduction to Schengen Visa Insurance

- 2025 Insurance Requirements and Regulations

- Understanding Coverage Types and Limits

- How to Select the Right Insurance Policy

- Digital Verification and Documentation

- Cost Analysis and Saving Strategies

- Common Mistakes and How to Avoid Them

- Frequently Asked Questions

Introduction to Schengen Visa Insurance

Travel insurance for Schengen visa applications isn't just a bureaucratic formality—it's a critical component that can make or break your European travel plans. As of 2025, Schengen Area countries have standardized and digitized their insurance verification processes, making it more important than ever to understand exactly what's required before submitting your visa application.

Schengen visa insurance, officially termed "travel medical insurance," provides coverage for potential medical emergencies, hospitalization costs, and in some cases, repatriation expenses that might occur during your stay in any of the 29 Schengen member states. The insurance requirement serves dual purposes: protecting visitors from potentially astronomical healthcare costs and safeguarding Schengen countries from bearing the financial burden of treating uninsured travelers. You can estimate the cost of appropriate coverage using our Visa Insurance Calculator.

With over 15 million Schengen visas issued annually, insurance verification has become increasingly stringent. According to the European Travel Information and Authorization System (ETIAS) data, inadequate insurance documentation accounts for approximately 8% of all Schengen visa rejections—a statistic that highlights the importance of getting this aspect of your application right.

The 2025 Schengen visa insurance verification process now includes digital validation through the ETIAS system, requiring specific QR codes and verification numbers on insurance certificates.

2025 Insurance Requirements and Regulations

The Schengen Borders Code establishes specific requirements for travel insurance that all visa applicants must meet. As of 2025, these requirements have been updated to include digital verification standards and expanded coverage areas.

Minimum Coverage Requirements

- Minimum Coverage Amount: €50,000 (increased from €30,000 in previous years)

- Geographical Coverage: All 29 Schengen Area countries, regardless of which specific countries you plan to visit

- Coverage Period: The entire duration of your intended stay or transit in the Schengen Area, plus an additional 15 days (new requirement as of January 2025)

- Covered Services: Emergency medical expenses, hospitalization, emergency dental care, medical repatriation, and repatriation of remains

- Zero Deductible Policy: Insurance must cover costs from the first euro spent, with no deductibles or co-payments

- Assistance Services: 24/7 emergency assistance services with multilingual support

The 2025 regulations have introduced several notable changes, including the increased minimum coverage amount and the requirement for an additional 15-day buffer period. This buffer ensures you remain covered even if unforeseen circumstances extend your stay, such as flight cancellations, medical emergencies, or natural disasters. For a complete overview of all documentation needed for your application, use our Document Checklist Generator.

Important Update for 2025:

As of March 2025, all insurance certificates must include a Schengen Insurance Verification Number (SIVN) and QR code that links to the European Insurance Verification System (EIVS). This digital verification system allows consular officers to instantly validate your insurance coverage.

Understanding Coverage Types and Limits

Not all travel insurance policies are created equal, and understanding the nuances of coverage types can save you from unexpected expenses and potential visa rejection. Here's a breakdown of the essential coverage components for Schengen visa insurance:

Medical Expenses Coverage

This forms the core of your Schengen insurance policy and should include:

- Emergency Medical Treatment: Covers costs for sudden illnesses or injuries requiring immediate medical attention

- Hospitalization: Inpatient care, including room and board, physician services, and surgical procedures

- Outpatient Services: Doctor visits, diagnostic tests, and prescribed medications

- Emergency Dental Care: Treatment for acute dental pain or trauma (typically limited to a specific amount, often €250-€500)

- Pre-existing Condition Coverage: While not mandatory for visa approval, this provides valuable protection for travelers with chronic conditions (note that this typically comes at a premium)

Repatriation Coverage

Repatriation benefits are critical components that must be explicitly stated in your policy:

- Medical Repatriation: Transportation to your home country if medically necessary

- Repatriation of Remains: Transportation of remains to your home country in case of death

- Medical Evacuation: Transportation to the nearest adequate medical facility if treatment isn't available locally

While the following coverages aren't strictly required for visa approval, they provide valuable additional protection:

- Trip Cancellation/Interruption: Reimbursement for non-refundable expenses if you need to cancel or cut short your trip due to covered reasons

- Baggage Loss/Delay: Compensation for lost, stolen, or delayed luggage

- Travel Delay: Coverage for additional expenses incurred due to significant travel delays

- Personal Liability: Protection if you accidentally injure someone or damage property during your trip

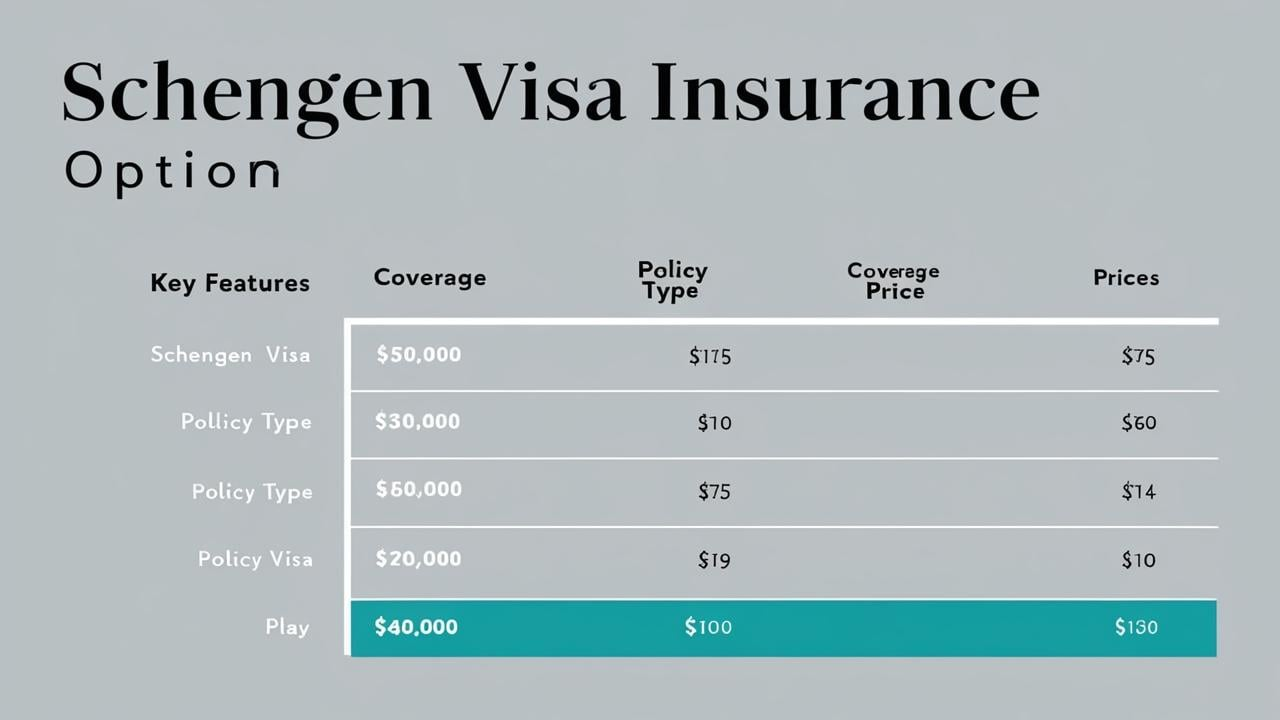

Comparison of basic, standard, and premium Schengen visa insurance plans showing coverage limits and additional benefits available in 2025.

How to Select the Right Insurance Policy

Choosing the appropriate insurance policy requires careful consideration of your specific travel plans, health status, and budget. Follow these steps to ensure you select a policy that meets both visa requirements and your personal needs:

Step 1: Verify Schengen Compliance

Before considering any policy, confirm that it explicitly states compliance with Schengen visa requirements. Look for phrases like "Schengen-approved" or "Meets Schengen requirements" in the policy description. Reputable insurers will clearly indicate this compliance and provide the necessary documentation format accepted by consulates.

As of 2025, all compliant policies must provide:

- A standardized insurance certificate with the SIVN number

- QR code linking to the EIVS verification system

- Clear statement of the €50,000 minimum coverage

- Explicit mention of coverage for all Schengen states

Step 2: Assess Your Travel Profile

Consider these factors when selecting your policy:

- Trip Duration: Ensure coverage for your entire stay plus the mandatory 15-day buffer

- Travel Itinerary: If your trip extends beyond the Schengen Area, look for policies with broader geographical coverage

- Planned Activities: If engaging in sports or adventure activities, verify these are covered

- Health Status: Consider pre-existing condition coverage if relevant

- Age: Note that premiums typically increase for travelers over 65, and some policies have age limits

Step 3: Compare Providers and Policies

With dozens of insurance providers offering Schengen-compliant policies, comparison shopping is essential. Consider these factors:

- Reputation and Reliability: Research customer reviews and claims processing efficiency

- Direct Billing Arrangements: Policies that offer direct payment to medical providers are preferable to those requiring you to pay upfront and claim reimbursement later

- Assistance Services: Evaluate the quality of 24/7 emergency assistance, including language support

- Digital Tools: User-friendly apps and online portals for policy management and claims submission

- Price vs. Value: While cost matters, the cheapest option isn't always the best—balance premium costs against coverage benefits

Many travelers find that specialized Schengen visa insurance providers often offer better value than general travel insurance companies, as their policies are specifically designed to meet consular requirements without unnecessary add-ons that inflate premiums.

Digital Verification and Documentation

The 2025 introduction of the European Insurance Verification System (EIVS) has digitized and standardized the insurance verification process. Understanding this system is crucial for ensuring your application proceeds smoothly.

The EIVS System

The EIVS is an integrated database that allows instant verification of insurance policies across all Schengen member states. When purchasing a compliant policy, your insurance provider registers it in the EIVS and provides you with:

- A unique Schengen Insurance Verification Number (SIVN)

- A QR code that links directly to your policy details in the EIVS

- A standardized digital certificate that contains all required information

Consular officers scan the QR code during application processing to instantly verify your coverage details, eliminating the previous manual verification process that often caused delays.

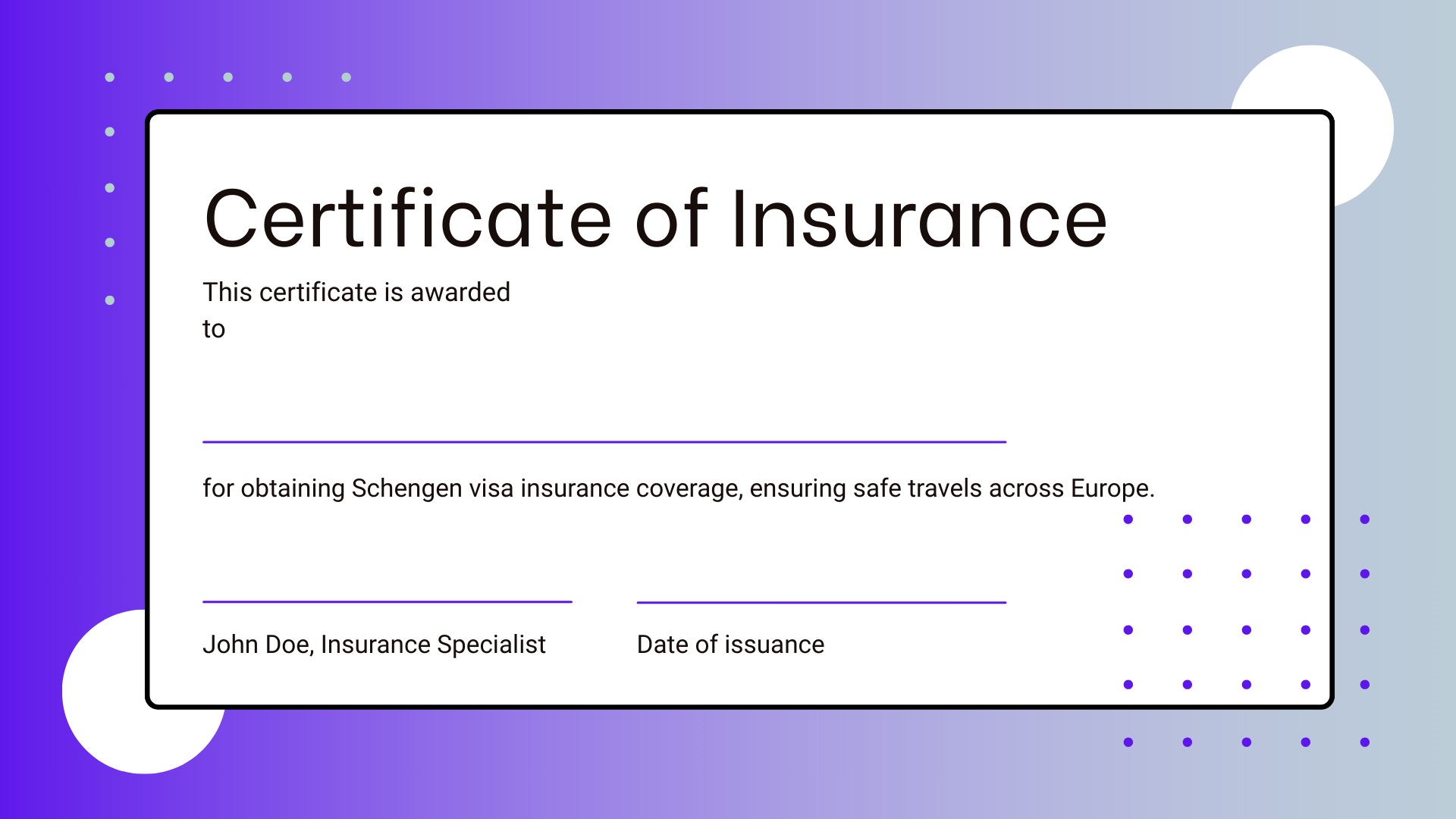

Required Documentation Format

Your insurance certificate must include:

- Policyholder's full name (exactly matching your passport)

- Policy number and SIVN code

- Coverage dates (clearly showing they encompass your entire stay plus 15 days)

- Geographical coverage (explicitly stating "All Schengen Area countries")

- Coverage amount (minimum €50,000)

- Covered benefits (medical expenses, hospitalization, repatriation)

- Insurance company contact information, including 24/7 emergency assistance numbers

- QR code linking to EIVS verification

Pro Tip:

Always carry both digital and physical copies of your insurance certificate during your travels. While the digital verification system has streamlined the application process, border officials may still request to see your insurance documentation upon entry to the Schengen Area.

Cost Analysis and Saving Strategies

Schengen visa insurance costs vary widely based on several factors, including coverage duration, traveler's age, and selected benefits. Understanding these variables can help you find cost-effective options without compromising on essential coverage.

Average Cost Breakdown

As of 2025, typical Schengen visa insurance costs range from:

- Short stays (1-2 weeks): €30-€60 for travelers under 60

- Medium stays (2-4 weeks): €50-€100 for travelers under 60

- Long stays (1-3 months): €100-€250 for travelers under 60

- Senior travelers (60+): Typically 50-100% higher than the rates above

Premium policies that include coverage for pre-existing conditions, high-risk activities, or additional benefits like trip cancellation can cost 30-50% more than basic Schengen-compliant policies.

Cost-Saving Strategies

Consider these approaches to reduce your insurance costs without sacrificing necessary coverage:

- Multi-Trip Policies: If you plan to visit the Schengen Area multiple times within a year, annual multi-trip policies often provide better value than purchasing separate policies for each trip

- Group and Family Policies: Many insurers offer discounts for couples, families, or groups traveling together

- Comparison Platforms: Use specialized insurance comparison websites that focus on Schengen-compliant policies to quickly compare options from multiple providers

- Direct Providers: Purchasing directly from insurance companies often costs less than buying through intermediaries or travel agencies

- Loyalty Programs: Some insurers offer discounts for returning customers or members of certain organizations

- Bundling Options: If you need additional travel services like flight cancellation protection, bundled packages may offer better value than purchasing separate policies

Important Consideration:

While cost matters, never sacrifice essential coverage to save money. The minimum €50,000 coverage requirement exists for good reason—medical emergencies in Europe can be extremely expensive. A hospital stay can easily cost €1,000-€3,000 per day, and medical evacuation can exceed €25,000.

Common Mistakes and How to Avoid Them

Even experienced travelers can make mistakes when purchasing Schengen visa insurance. Here are the most common pitfalls and how to avoid them:

Insufficient Coverage Period

The Mistake: Purchasing insurance that covers exactly your planned stay without the required 15-day buffer.

How to Avoid It: Always add at least 15 days beyond your planned return date. Remember that visa officers often grant visas with additional days beyond your requested period, and your insurance must cover this entire potential stay.

Overlooking Geographical Limitations

The Mistake: Purchasing policies that cover only specific Schengen countries rather than the entire Schengen Area.

How to Avoid It: Verify that your policy explicitly states coverage for "All Schengen Area countries" or lists all 29 member states. This is especially important if you plan to visit multiple countries, as your visa allows free movement throughout the entire Schengen Area.

Misunderstanding Coverage Limits

The Mistake: Confusing sub-limits with overall coverage limits. Some policies advertise €50,000 coverage but impose much lower sub-limits on specific services like emergency dental care or repatriation.

How to Avoid It: Carefully review the policy's table of benefits to understand any sub-limits. The €50,000 minimum should apply to emergency medical expenses as a whole, not just to specific categories of care.

Purchasing from Non-Recognized Providers

The Mistake: Buying insurance from companies not recognized by Schengen authorities, resulting in visa rejection.

How to Avoid It: Purchase from established insurance companies that specifically mention Schengen compliance and provide the required SIVN number and QR code. If uncertain, check the European Commission's list of recognized insurance providers or consult the specific consulate where you'll apply.

Inadequate Documentation

The Mistake: Submitting insurance certificates that lack required information or proper formatting.

How to Avoid It: Ensure your certificate explicitly states all required elements: coverage amount, geographical scope, covered benefits, policy period, and emergency contact information. With the 2025 digital verification system, also verify that your certificate includes the SIVN number and QR code.

Example of a 2025-compliant Schengen visa insurance certificate showing all required elements including the SIVN number and verification QR code.

Frequently Asked Questions

Can I use my existing health insurance for a Schengen visa application?

Regular health insurance policies, including national healthcare plans and private health insurance, typically don't meet Schengen requirements. However, some international health insurance plans may qualify if they explicitly cover all Schengen countries, provide the minimum €50,000 coverage, include repatriation benefits, and can provide the standardized certificate with SIVN number. Always check with your insurance provider and request written confirmation of Schengen compliance.

Do I need insurance if I'm visiting for less than 90 days?

Yes, insurance is mandatory for all Schengen visa applications regardless of stay duration. Even for short visits of just a few days, you must have insurance that meets all Schengen requirements.

What happens if my visa duration is longer than my initial insurance coverage?

Your insurance must cover the entire potential duration of your stay plus 15 days. If your visa is issued for a longer period than your insurance covers, you risk being denied entry at the border or facing problems during your stay. Some travelers purchase extendable policies that allow them to increase coverage if their visa is granted for a longer period.

Can I purchase insurance after submitting my visa application?

No, proof of appropriate insurance is a required document for your visa application. You must purchase insurance before submitting your application and include the certificate with your application documents.

Is travel insurance required for EU citizens or residents?

EU citizens and legal residents of EU countries don't need to apply for Schengen visas and therefore aren't subject to the insurance requirements discussed in this article. However, travel insurance is still highly recommended for any international travel.

What if I have a pre-existing medical condition?

Standard Schengen visa insurance typically excludes pre-existing conditions. If you have such conditions, you have two options: purchase a premium policy that covers pre-existing conditions (at a higher cost) or accept that your regular treatment won't be covered and only emergencies unrelated to your condition will be covered. Always disclose your medical history honestly when purchasing insurance to avoid claim denials.

Conclusion

Navigating Schengen visa insurance requirements may seem complex, but understanding the fundamentals outlined in this guide will help ensure your application proceeds smoothly. Remember that insurance isn't just a bureaucratic requirement—it provides essential protection during your European travels.

With the 2025 digital verification system now fully implemented, the process has become more standardized and efficient, but it also means there's less room for error in your documentation. Take time to research providers, understand policy details, and verify that your insurance meets all requirements before submitting your visa application.

By following the guidance in this article, you'll not only satisfy visa requirements but also travel with the peace of mind that comes from knowing you're properly protected throughout your Schengen adventure.

Disclaimer: This article provides general information about Schengen visa insurance requirements as of May 2025. Requirements may vary by country and can change over time. Always verify the most current requirements with the specific embassy or consulate where you'll submit your visa application.

Need Help With Your Visa Documents?

Our document generation tools can help you create professional visa application documents quickly and accurately.